P>That pay, so line tens us to add line seven, eight, nine, and this is your total payments and credits. Well, obviously, we're not adding anything to it, so we're going to simply just keep the five thousand four hundred and eighty dollars. We're going to go ahead and move down a little bit, let's move our screen up on line 11. It says use the amount on line 6 above to find your tax in the tax table on pages 27 through 35 of the instructions. Okay, this is where you're going to use the 2009 tax return that looks like this, that you guys all should have used in the first section that we had. So we're going to take this table and we are going to flip, and if you notice, hold on, the camera might get degree here for a second, but if you notice on each of the pages there's a block of amounts. So this is like the 4000 block, well we're going to look for the 28000 block. So we're going to flip our pages, bear with me for just a moment. So here we have, we have found the 28000 block on our 2009 tax table and in the 28000 block we want to find that they spent, he paid, I'm sorry, his taxable income is 28 thousand six hundred and forty dollars. So 20,000, so he's a he's made at least 28 thousand six hundred but less than 28,000 650, he is filing single. So right here we're going to type in three thousand eight hundred and sixty-nine dollars is how much he should have paid in taxes. Okay, I'm going to go ahead and put the camera back so that we can see our tax table, I mean our tax...

Award-winning PDF software

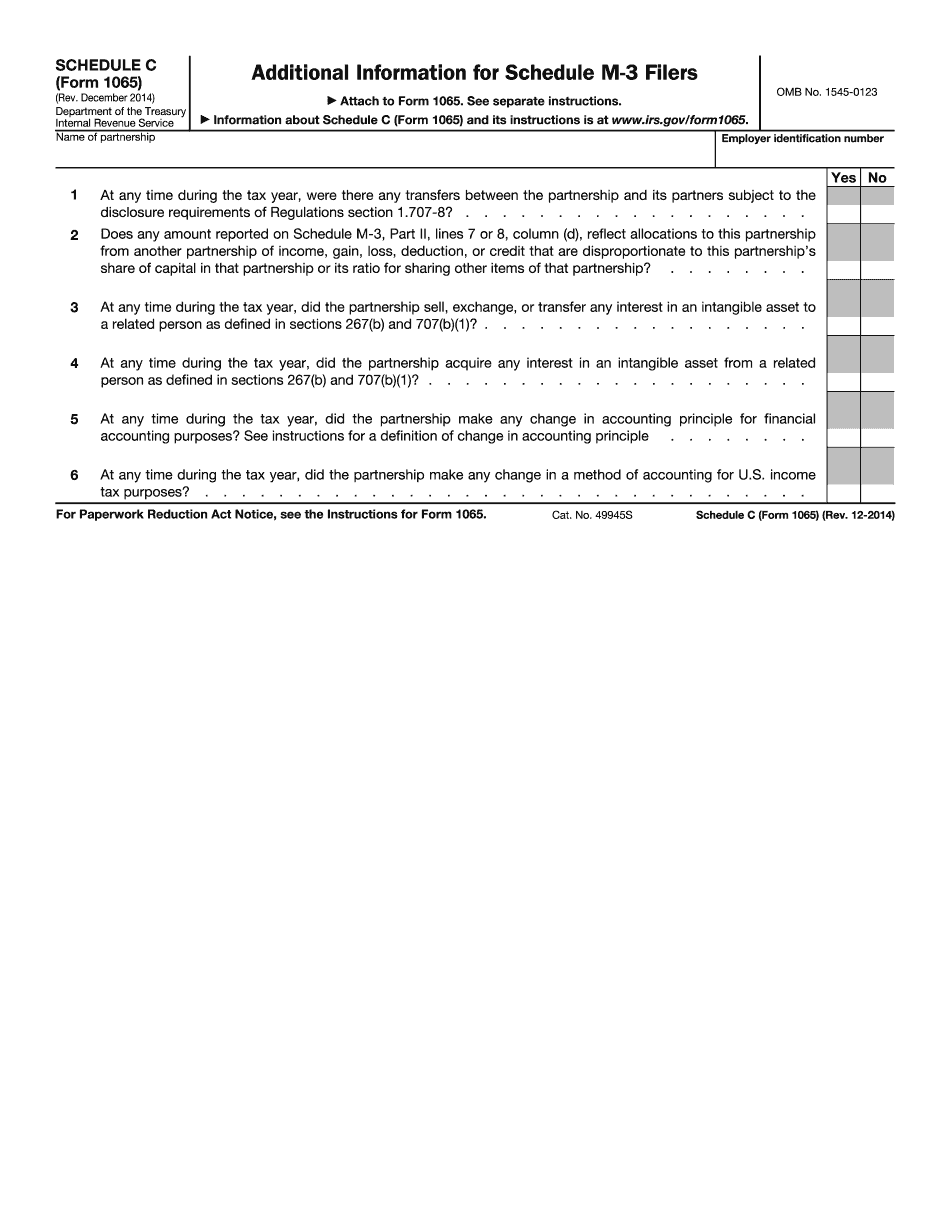

Schedule b-2 1065 Form: What You Should Know

The Form 1040X is no longer required for the current tax year. The last day for filing Form 1045 is January 31st 2019. The Form 1045 is not required for the current tax year. Instructions for Form 1045 (2021) | IRS Mar 1, 2025 — Income tax filing (Form 1040X) must include a statement that provides the taxpayer's total tax liability for the year in which the return is filed. The tax liability must be estimated based on the taxpayer's total income, deductions, credits, and tax effects. Individuals can get a refund by filing Form 1040X, Amended U.S. Individual Income Tax Return, instead of Form 1045. A Form 1045 must be filed for each year they NOT will be claimed and/or carry back.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 (Schedule C), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 (Schedule C) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 (Schedule C) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 (Schedule C) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule b-2 form 1065