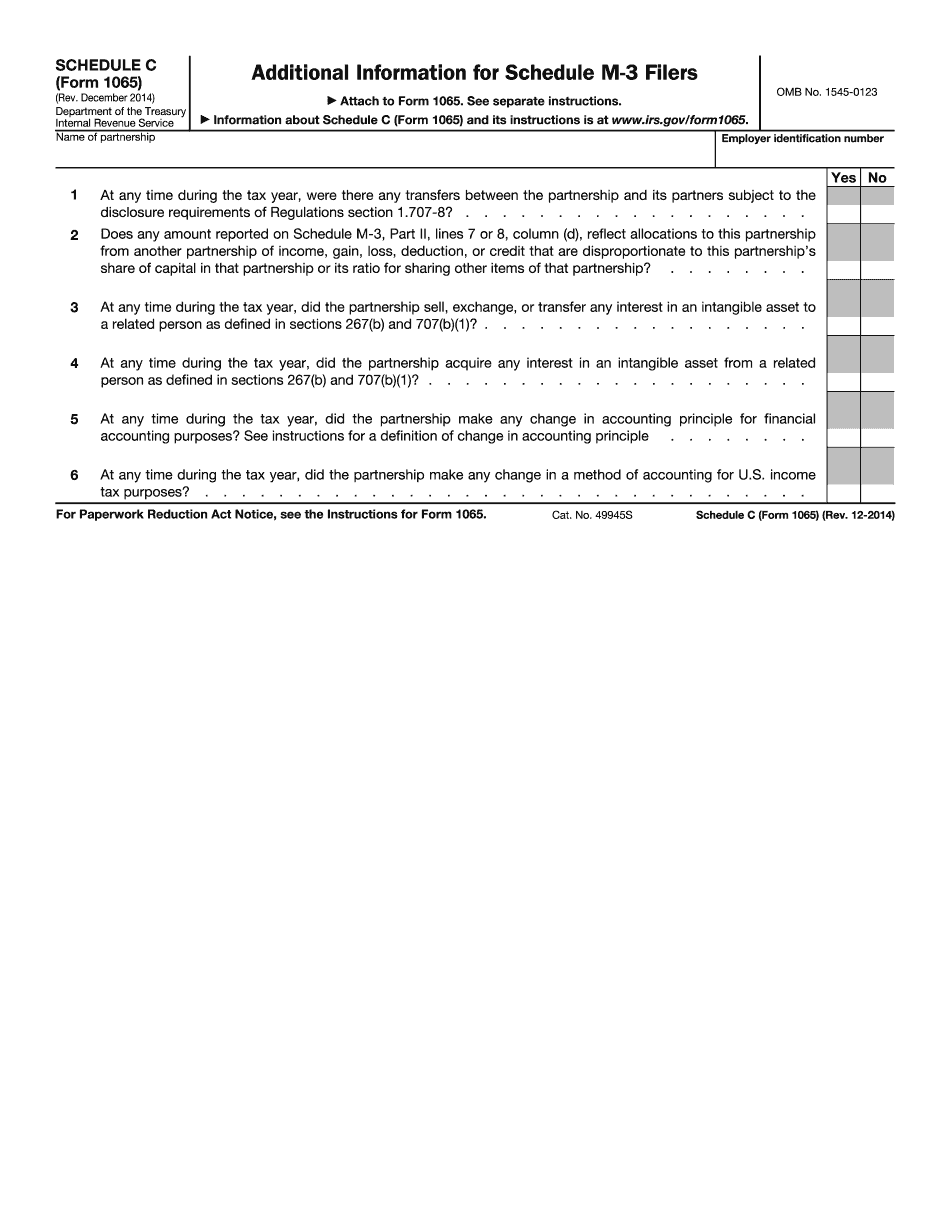

Here are the 13 actionable steps you need to take to start your business in US in 2018:1. Decide which business type is right for youYou first will need to decide on which business type is right for youu2026LLC or C-Corporation or S-CorporationThe decision to choosing the correct business type is important because the type of business you create determines your tax responsibilities and important personal liability.Itu2019s important to understand each business type and select one that is best suited for your situation and objectivesu20262. Decide where you should form your LLC or CorporationIf youu2019re a US resident, you should form your LLC or Corporation in the state in which you have physical presence.For example, if youu2019ll be operating your business in California, then you SHOULD form your LLC in California.However, if youu2019re a non-US resident and you do NOT plan to have physical presence in the US (meaning that it will operate solely from outside of the US), then you should form your LLC in Delaware, the best and most business-friendly state for non-US residents.3. Get a Registered AgentCost: $45 to $100/yearLLCs and Corporations are required by law to designate and have a Registered Agent with a physical address (not a P.O. Box) during normal business hours to receive important documents on behalf of the business.Registered Agent is someone with an address in the state where you want to form your LLC in Corporation who accepts legal documents on behalf of your business.Think of the Registered Agent as a service to ensure you donu2019t miss any important documents related to lawsuits or state taxes.These documents include documents related to lawsuits and renewal notices from the state.Note that a P.O. box is not accepted for a Registered Agentu2019s address.Keep in mind that a Registered Agent is not a mail forwarding service and you cannot use the Registered Agent address as your businessu2025 legal address, or even the mailing address of your company.Registered Agent requirements:Registered Agent must be physically located in your state of formationRegistered Agent must be present at that address continuously during business hoursRegistered Agentu2019s name and address must always be kept current with the state, andRegistered Agentu2019s information will become publicly and can easily be searchable.To reiterate, you do not need a U.S. address to incorporate a business in United States. Having a Registered Agent is the only requirement related to physical address.Having a Registered Agent will allow you to form an LLC or Corporation in the U.S..However, in order to obtain an Employer Identification Number (more on this later) or open up a bank account, you are going to need a U.S. mailing address (not necessarily in the state of formation). In this case we recommend you to look for a u201cmail forwardingu201d service provider (more on that below)You can always shop around online for the best and cheapest Registered Agent service in your desired state of formation u2025 prices will vary from $45 to $100 per year. Please note that this is a recurring fee which youu2019ll have to pay for every year.If you need a recommendation for a good Registered Agent service, send me an email at sam@mollaeilaw.com4. Register an LLC or CorporationCost: $400 to $1,200After youu2019ve decided which business type is right for you (if you still donu2019t know, you can email me at sam@mollaeilaw.com), and after youu2019ve decided in which state you should form your business in, then you should look to register your LLC or Corporation by filing the necessary filings.As a business lawyer, I help entrepreneurs form their LLC or Corporation (depending on which type is right for them).Forming your LLC or Corporation yourself and making sure youu2019re doing everything correctly is complicated and unless you have a lot of time and patience, I would not recommend it.. Apply for your Employer Identification Number (EIN) (Tax ID)Every business in United States needs an Employer Identification Number (EIN) (also known as Tax ID number) to start a business.EIN is a Tax ID number issued by the U.S. Internal Revenue Service (IRS) to identify a business.Think of an EIN as the social security number for your business. Just as a social security number is important for U.S. citizens to have, an EIN is necessary for an LLC or corporation to lawfully conduct business activities in United States.You will need an EIN to:Start a businessOpen a U.S. bank accountHiring employeesFile taxesIf you are a US citizen and you have a Social Security Number (SSN), you may apply for your EIN using IRSu2019s online website here.However, if youu2019re a non-US citizen, you most likely donu2019t have a Social Security Number (SSN) or Individual Tax Identification Number (ITIN).If you donu2019t have an SSN or ITIN, you should do the following:Get a business lawyer to act as your third-party designee for youThe business lawyer will prepare your EIN application and file your EIN application with the IRSThe business lawyer will receive your EIN on your behalfTo guarantee completion of the EIN application process, I HIGHLY recommended having a business lawyer act as your third-party designee apply for your EIN on your behalf.Read more here: How to Get Employer Identification Number (EIN) without SSN or ITIN6. Get a U.S. Mailing Address (if necessary)Cost: $10/monthMost U.S. banks also require a mailing address or residential address for opening a bank account.You can provide your business address if you have a business address in United States.However, if you donu2019t have a U.S. address, you can use one of the following companies to get a U.S. address:TravelingMailBox.com (from $15/month) (most recommended)USAMail1.com (from $10/month)EarthClassMail.com (from $99/month) (expensive)These services provide a U.S. mailing address for your business.They scan your mails and send you an email. You can either view your mails online or forward those mails to any other international address no matter where you live.Please note that before you can use their service or forward mail in your mailbox, you may need to submit Form 1583 from the United States Postal Service (USPS) to authorize these services to open your mails on your behalf.Form 1583 only authorizes these services to receive mail on your behalf. It does not forward any of your current mail to them.To forward all your mail to your mailbox, you need to submit a Change of Address request to USPS.For instructions on how to do this, you can read this article.If you do not want to forward all your mail to the mailbox, do not file the Change of Address with USPS.Instead, you will need to manually update mailing addresses with those who you want to have mail sent to your new mailbox. Then they will send you automatic email notifications when you receive new postal mail in your mailbox.7. Open a U.S. Business Bank AccountCost: Usually FreeMost non-U.S. residents find this step the most challenging when it comes to setting up a business in United States.If you already have a personal bank account with a US bank you can try calling them to open a business checking account. This is the best option if you already have a personal bank account.If you donu2019t live in United States, I would suggest finding a US bank in your country (typically Bank of America, Citi Bank, or Wells Fargo) and calling them to ask what they require.In most cases, you will be required to walk in to the bank and provide proof of ID (your drivers license or passport) and your EIN.If you are planning to visit the US in the near future, you can just walk into a bank with the incorporate documents and your EIN to open a bank account.Be careful: nobody can do this for you and if you find a company offering this service, be aware that you could be victim of fraud.Below youu2019ll find my advice on how you can open a US bank account as a non-US resident. Most of my clients have been able to use this advice to help them successfully open a US bank account.In response to the 9/11 attacks, The Patriot Act has made it difficult for foreigners to open a U.S. bank account.The Patriot Act requires that banks verify the identity of any person opening an account, and that these persons pass all mandatory anti-money laundering and anti-terrorism checks.The Patriot Act also makes it nearly impossible if you are from Iran, Iraq, Afghanistan, Pakistan, North Korea, Sudan, Western Balkans, Burma, Liberia, Zimbabwe, or if your name appears on the OFAC (Office of Foreign Assets Control) list of blocked persons or companies.The requirements for opening a business bank account vary from bank to bank, but typically you will need your incorporation documents (Articles of Organization for an LLC or Articles of Incorporation for a Corporation), your Employer Identification Number (EIN), and 2 pieces of photo identification (such as a Passport or ID card).8. Open a Merchant Account to Accept PaymentCost: FreeThe most popular options for opening up a merchant account are:Stripe.com (does not require a SSN, all you need is an EIN)Payoneer.com (great for non-US residents)Braintreepayments.comAuthorize.netPaypal.com (requires SSN which most non-US citizens do not have)You can also find other alternatives to Paypalhere since Paypal requires a Social Security Number (SSN) which most non-U.S. citizens do not have.9. Get a U.S. Phone NumberCost: Free to $9/monthYour best option is to get a Google Voice number for free and a Skype number ($50 per year).If youu2019re looking to get a 1-800 number, I recommend freedomvoice.com or grasshopper.com10. Understand your Tax ResponsibilityIf youu2019re a non-US resident, youu2019re taxed in the US only on US-source income.If youu2019re a US resident, youu2019re taxed on your worldwide income.Iu2019m not an accountant, and I strongly advise that you consult with an accountant about how to deal with business taxes as a non-US resident.Also, you can refer to this page to help you figure out your tax responsibilities.Non-U.S. businesses that do not operate in the United States (for example, do not have any income from U.S. sources), do not owe any federal income taxes; however, there may be annual state charges or fees for maintaining the LLC or Corporation.Non-U.S. companies that do not want to form a business here but merely wish to import their products to the United States should explore import rules by reviewing the Commercial Importing Procedures and Requirements.As a non-U.S. resident, your LLC will only be taxed in the U.S. on income from U.S. sources, meaning that income from other countries will not be taxed by the U.S.If you choose to form an LLC, any profits U.S.-sourced income will be taxed by 30%. This 30% goes to the IRS. At the end of the year, you will file your U.S. taxes on Form 1040-NRwith the actual amount due. If the amount due is less than the 30% initially taxed, the IRS will issue a refund in the amount overpaid.To make sure the LLC is sending the proper amount to the IRS, the LLC must designate a tax withholding agent to calculate the proper amount that must be sent to the IRS before any of the money is released.Because of these difficulties, many non-U.S. residents choose to form Corporations, unless they are forming the LLC to do business strictly outside of the U.S., in which case, the LLC would not owe any U.S. taxes.If you form a Corporation, your Corporation will be taxed as like any other U.S. corporation. The corporation will pay the same taxes that any other U.S. Corporation would on all U.S.-sourced income and your Delaware Corporation would also be taxed on all foreign earnings, in accordance with U.S. Treasury regulations. Since the corporation was formed in the United States, it is taxed as a domestic corporation and you will file Form 1120.If you form an LLC, you will need to file annual tax returns Form 1065.If you form a Corporation, your Corporation will have to file an annual tax return (Form 1120). Your State of Incorporation will also probably request that you renew your incorporation via a form which updates the address of the corporation, its officers and directors, and its registered agent for service of process.Also, annual tax returns Form 1040 Schedule C are filed by sole proprietorships and IRS Form 1065 for General Partnerships.If you have any other questions regarding your tax responsibilities as a non-U.S. international resident, visit IRSu2019s website of Taxation of Nonresident Aliens and IRSu2019s International Taxpayers portal.Again, we highly recommend talking to an accountant regarding your tax responsibilities as tax laws are very complicated in United States.12. Keep your business and personal accounts separateIf you do form an LLC or Corporation, make sure to keep your business and personal accounts separate.Keeping your business assets separate from your personal assets can help ensure that your LLC or Corporation is solely liable for its debts and liabilities, and that you and other members are protected.This is very important.If you donu2019t maintain this financial separation, you risk losing the liability protection that your LLC or Corporation provides.To get started separating your assets, follow these steps:Consider opening a bank account and credit card account that is entirely in the LLCu2019s name that will be used only for business expensesConsider moving personal property that will be used by the LLC, such as real estate or a vehicle, out of your name and into the name of the LLC11. Maintain & Pay Annual Fees on TimeKeeping your LLC or Corporation compliant is essential and continues long after youu2019ve formed your business.If you do not maintain your LLC or Corporation according to U.S. law, your personal liability protection will be pierced, putting your personal assets at risk.For a non-U.S. residents, compliance with the law is absolutely essential to avoid visa, immigration and tax problems.Most states have some form of an ongoing cost for having an LLC or Corporation.In Delaware, the ongoing cost of a Delaware LLC is an annual fee of $300 due by June 1st, beginning the year following formation.In California, all California LLCs, regardless of income or activity, must pay an $800 Franchise Tax fee every year. $800 payment for the LLC Franchise Tax is due by 15th day of the 4th month after your LLC is filed.So make sure you understand what your annual fees are and make sure you pay it on time.12. Make sure youu2019re complying with city or county (if youu2019re a US resident)Even though you have complied with state laws to form your LLC or Corporation, you need to also contact the city or county where your LLC is located to determine if you need any business license or permit.These requires vary, depending on where your business is located, and what what industry youu2019re in.Please be sure to check with your city or county regarding any required business registrations.13. Bonus: Other Useful ToolsHereu2019s a list of other useful tools I recommend when youu2019re starting your business:HelloFax.com u2025 fax number and allows you to fax out documents easily. Post incorporation will require you to fax in & receive a fax back from the Secretary of State or the IRS easily.HelloSign.com u2025 makes it easy to important documents and sign those documents online. There will be plenty of PDF documents during and after the business incorporation process that will need to be signed.Any help regarding this, visit us at www.wazzeer.com