Award-winning PDF software

form 1065 instructions: step-by-step guide - nerdwallet

The purpose of this form is to report the income, profits, losses and deductions from your partnership for the taxable year. The information on the form is often used to satisfy the tax requirements of the partnership and in some cases to support other agreements between you and your partner. The IRS may not require you to file this income tax return. However, the IRS is required to provide income tax information to you and may collect some information that appears on the form. In addition to your gross income from your partnership activity, the IRS also requires certain information to be included for the taxable year. This information may be used for reporting to both you and your partner or in an agreement between the two of you as to the sharing of partnership income with your partner. This information consists of information that can be used to.

Is a schedule c for business the same as a 1065?

See ) Q: What constitutes the date on which I am required to file my tax return if I am a sole proprietor? A: You must file your tax return for taxable year 2015 or its first quarter. This is the date shown on your Form 1065. Q: What constitutes the date on which I am required to file my tax return if I am a single member LLC? A: You must file your tax return for taxable year 2014 or later. This is the date shown on your Form 1065. To file a return in any other taxable year, you must follow the instructions provided to you. Q: How am I required to report my net income and deductions for the taxable year? A: The basic method of reporting net income is shown on Schedule D, while the method of deducting expenses is shown on Schedule A. The net gross income on each.

schedule c (1065 form) | pdffiller

If you use a printout, the final results may include some “oversight”. The fillable file should be large enough to fit in your laptop or printer. It may also take a slight amount of time to edit. Form 20F Form 20F is not a complete declaration. It provides information about your source, including name, address, and occupation and includes instructions for how to complete the full declaration. Forms 20A and 20B These forms are not required. To determine if you need one of these forms, contact your tax services provider. If you choose to complete one of these forms, you must include a copy on your Tax Return. Form 30, Application for Nonresident Alien Status, If you are a nonresident alien, your application must include supporting documentation. You may be eligible to get an extension for up to two years beyond the start date of your period of controlled status. If.

Memo of major changes for instructions for schedule c (form

Internal Revenue Service. 2008. Instructions for Schedule H. (Form 1040). Additional Information for Schedule M-4 Filers. Department of Energy. July 16, 2001. Department's Notice of Recommended Rule making. Department of Interior, Bureau of Land Management. 2009. “Policy for the Treatment of Land Acquisition by Non-Governmental Parties.” US Bureau of the Census. May 13, 2008. Census of Consumer Expenditure. Data Sources and Methods. Department of State. 2007. “Guide for the Processing of Form W-7, Citizens' Affidavit of Nonresidence Form.

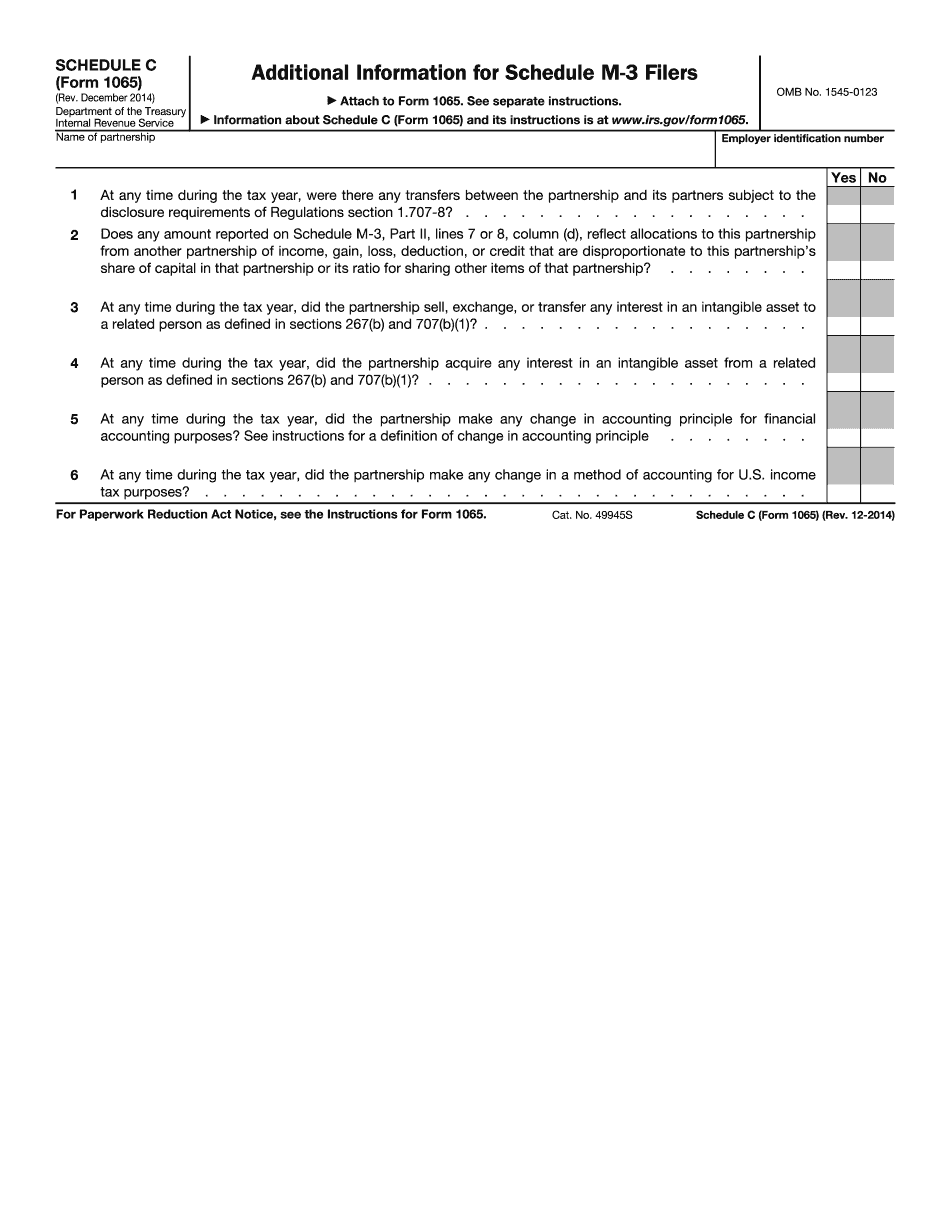

Download form 1065 schedule c "additional information

Form 1065 is a tax form that's used by your tax preparer to complete for you. The IRS doesn't allow the form for use by the taxpayer. What Do I Need To Bring? This form is most commonly used to claim the earned income tax credit (ETC). As the name suggests, this form allows you to claim the credit based on the income you earned — this does not apply to the Earned Income Tax Credit (ETC). The rules to claiming the ETC are complicated. To be a good tax prep, I'd recommend that you read the following article and use this form to claim it. If you do not claim the ETC, you will be able to get a refund from the IRS. (The IRS is in charge of collecting this money.) If you had no income last year, you can get an estimated tax for the year you were a.