Award-winning PDF software

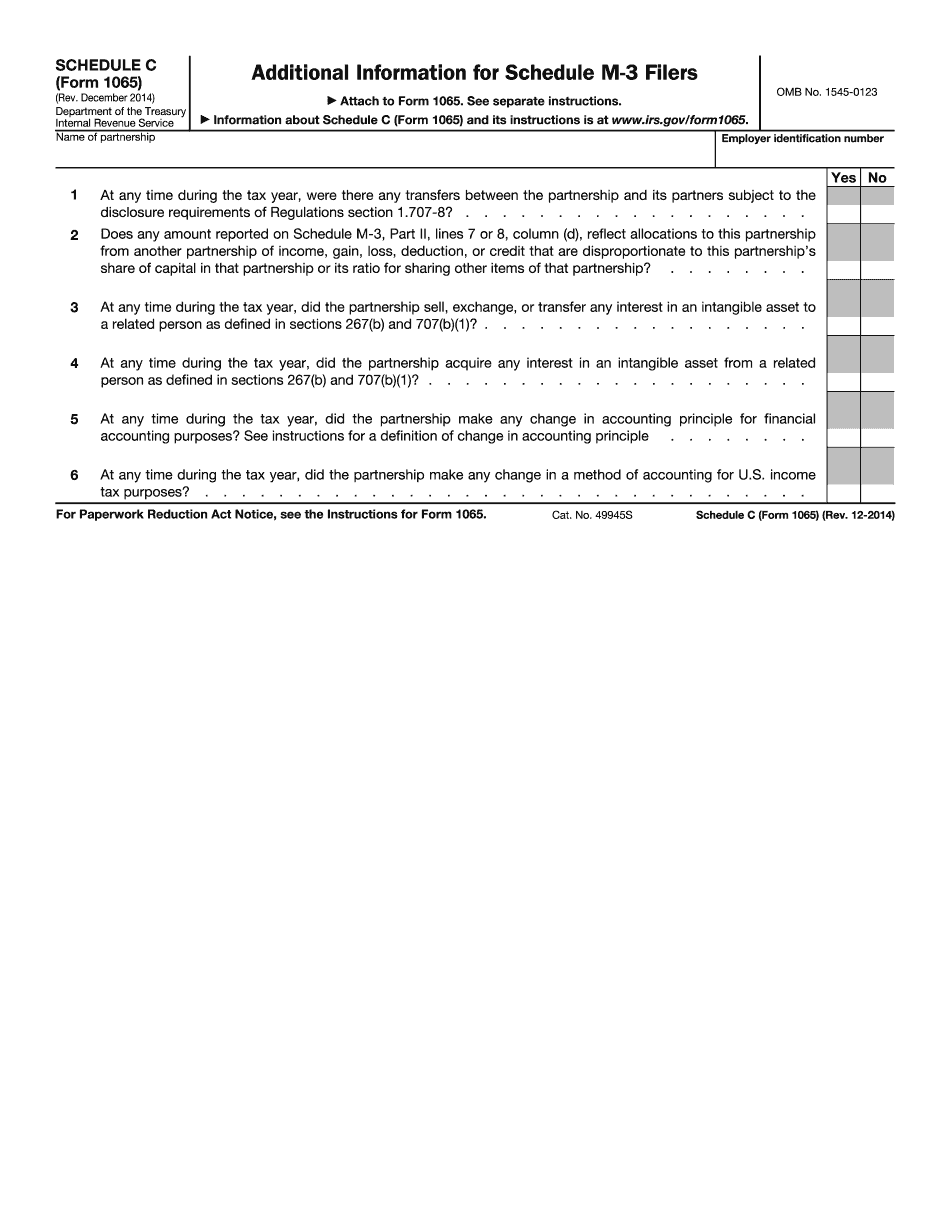

Form 1065 (Schedule C) for Stamford Connecticut: What You Should Know

The required date to submit an itemized list of payments must be no older than the last day of the calendar year after the due date of the ES 2018. Payments must be sent to the Connecticut Department of Revenue, P.O. Box 79049, Milford, CT 06258. The Connecticut Department of Revenue may receive checks made out to the Connecticut DOOR on the same business day. There is no deduction for this tax. This form must be submitted by mail, fax or emailed. CSA/S-Corp Structure Exemption — Connecticut.gov To be eligible for this tax exemption under section 501(c)(6) of the Internal Revenue Code, a corporation must be organized and operated solely for the promotion of social welfare or public convenience, and not to satisfy any other private interest.[5][9][3] The Corporation shall engage in limited liability under this section (and all the subsidiary rules) to enable it to qualify for the exemption. This exemption protects companies whose income is solely derived from the sale of property or services to which they owe and are entitled. [10] CSA/S-Corp Statement of Financial Position for ES 2025 — Connecticut.gov If a corporation is organized and operated exclusively for the promotion of social welfare or public convenience and a private benefit is derived, which makes it entitled to a tax benefit the amount of which is greater than the amount of any tax liability, then its balance sheet shall be used to determine if and on what basis the tax liabilities are classified.[3] Where to File Your Taxes for Form 1065 — IRS Connecticut Pass-Through Entity Tax — CT.gov Form CT-1065/CT-1120SI must be filed electronically and payments must be made electronically using either connect or the Connecticut Federal/State Electronic Connecticut Pass-Through Entity Tax — CT.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.