Award-winning PDF software

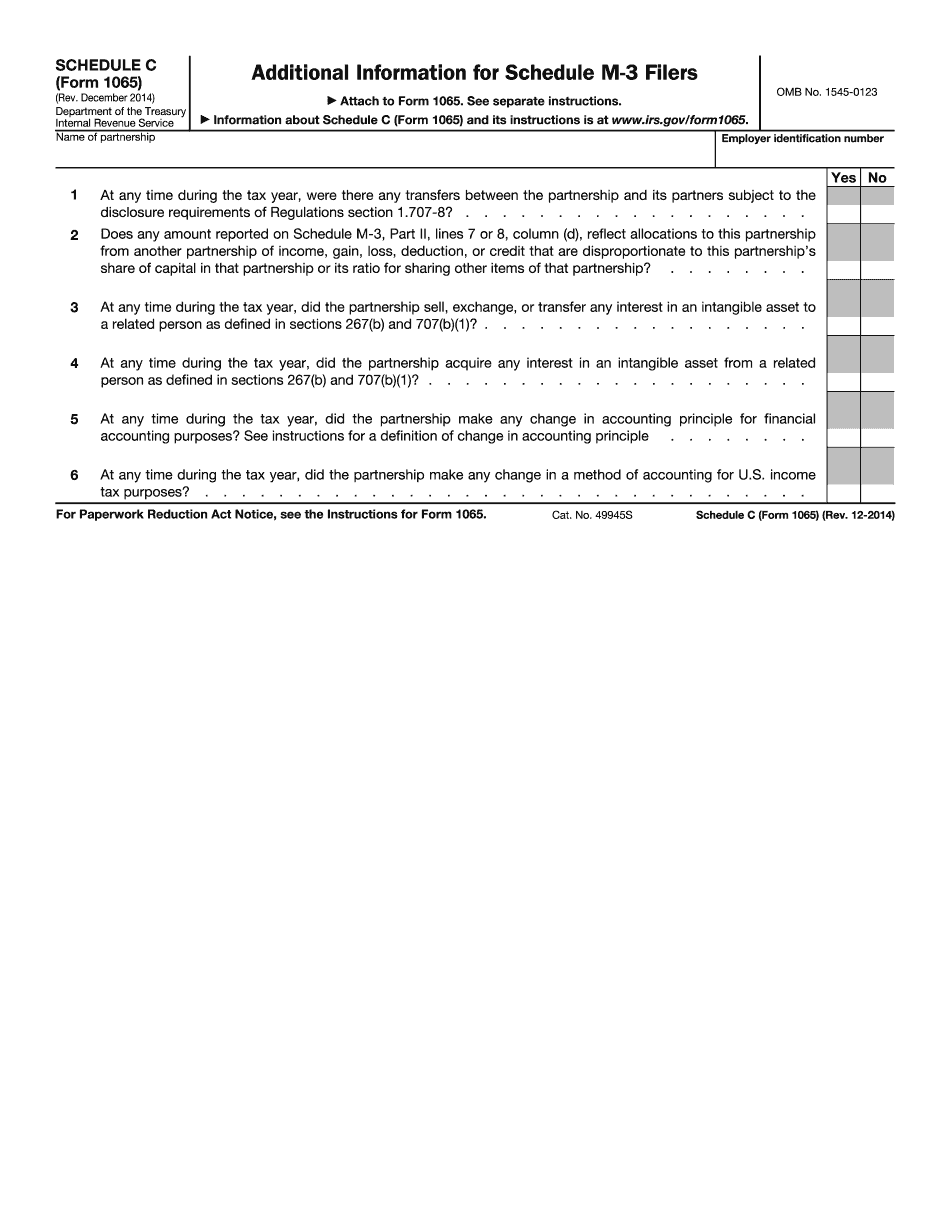

Form 1065 (Schedule C) for Syracuse New York: What You Should Know

Partnerships — TAXES — Syracuse University In 2014, the University of New York created a partnership agreement between its University and one of its alumni associations called UNIQUE. The agreement gives UNIQUE exclusive access to the resources of the University and the University may not rent or sell any of the resources of UNIQUE in a way that would allow the association to gain a direct financial benefit. The relationship between UNIQUE and the UNIQUE will continue by providing UNIQUE with a limited partnership interest in the university and allowing UNIQUE to participate in a range of UNIQUE activities, such as funding and conducting research. ▷ Form CT-13 is a partnership agreement and is used to report gross income reported on a Form 1040. Form CT-13: New York University of New York, Inc. with its principal place of business is the tax filing agent for the University, which is the owner of the partnership interest. Tax Forms — TAXES — UNIQUE/Rochester Institute of Technology In 2014, UNIQUE signed an agreement with the Rochester Institute of Technology to co-own the university with UNIQUE. The agreement includes a partnership agreement that provides an exclusive relationship with each school. This Agreement sets up a limited partnership interest and provides for the limited involvement of UNIQUE in activities of the Rochester Institute of Technology. The partnership is to be managed in the best interests of the schools so each college and university gets the most out of our partnership while the partnership itself remains responsible for its own financial management. Tax Forms — TAXES — UNIQUE/Hobart and William Smith Colleges/University of Phoenix (Current year only) Tax Forms — TAXES — UNIQUE/University of North Carolina Chapel Hill In 2015, the University of North Carolina made a commitment with the University of Phoenix to provide a comprehensive approach for students to enroll in the University of Phoenix's online programs through the University of North Carolina Network (UN CNET), with a significant impact on increasing access to degrees and credentials that will help students achieve their educational goals. ▷ The UNC Network agreement provides an exclusive partnership with the University of Phoenix which guarantees exclusive access to resources and services of the University of Phoenix. Business partners, including non-U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) for Syracuse New York, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) for Syracuse New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) for Syracuse New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) for Syracuse New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.