Award-winning PDF software

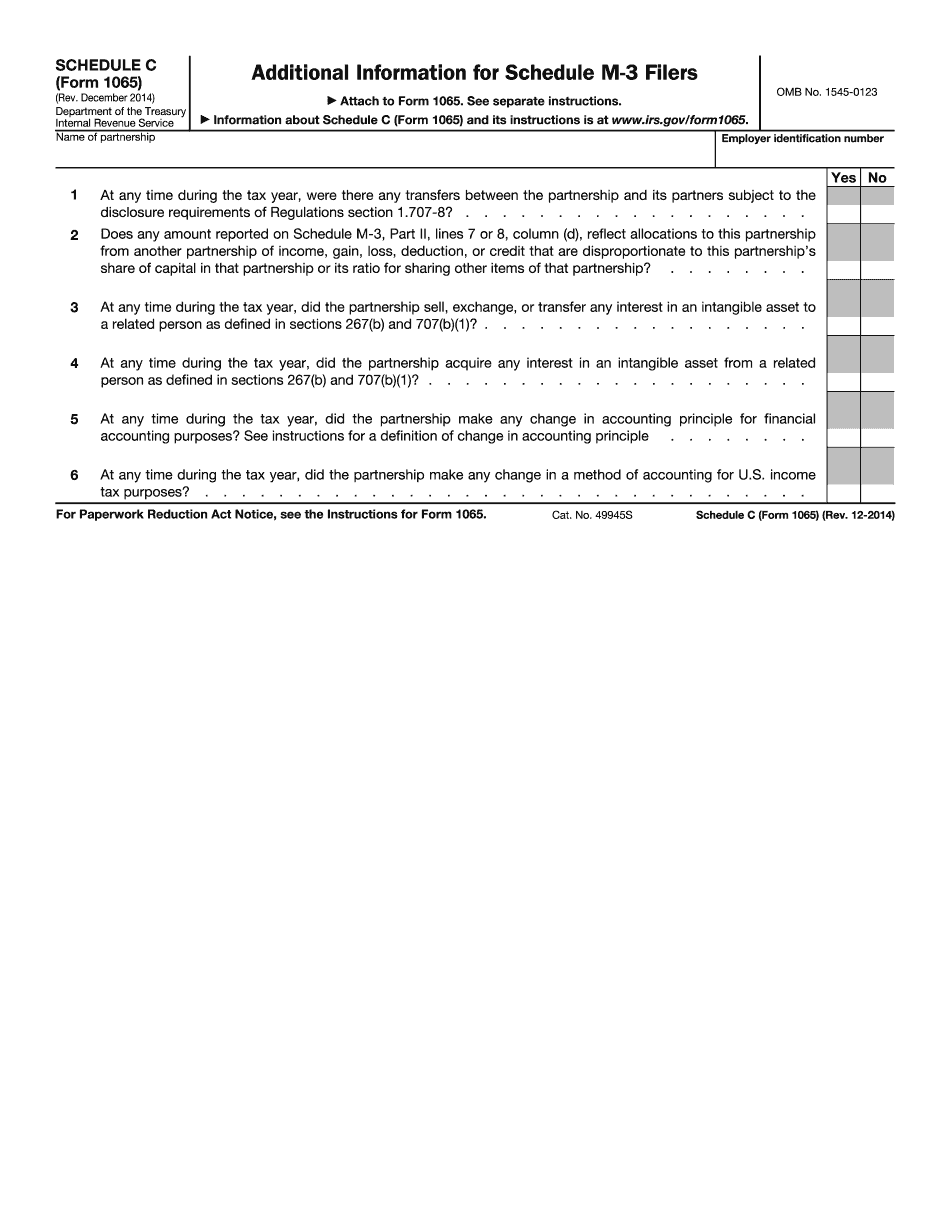

Form 1065 (Schedule C) for Tampa Florida: What You Should Know

How to Pay Yourself in a Florida Business Corporation For each entity, you pay one set of taxes before being taxed again. You'll be taxed twice on account of the LLC's profits for that year. How to Use Schedule K-1 to Pay Yourself in a Florida Business Corporation Florida Business Lawyer Tampa How to Pay Yourself in Florida Tax-Exempt Money Florida State Sales Tax — The Basics When filing your sales tax return, you must report the gross sales and the gross value of the taxable products sold, plus the taxable supplies sold for any taxable purchases. The basic forms and instructions below will help you file a proper tax return for your Florida state sales taxes. The Basics on Florida Sales & Use Tax : Florida sales tax does not apply to the sale of motor vehicles, or personal property of more than 2,500 in value. For the sales tax to apply, you must register in Florida prior to the sale. All sales must be final in Florida except those made in one of the following states: Alaska, Arizona, Idaho, Montana, Nevada, New Hampshire, North Dakota, Oregon, South Dakota, Utah or Vermont. If you are selling any non-commercial property, you must file a separate sales tax return. For commercial properties, you may still file a state tax return, if you live in one of these states: Alabama, Indiana, Louisiana, Michigan, Mississippi, New York or Tennessee. Sales/Use Tax in Florida: The tax rate is 8.75%. Any non-commercial sales over 895.90 are subject to tax, excluding food, clothing, household supplies and personal property of 'ordinary value'; Commercial Sales: Any commercial sale is subject to Florida's 8.75% sales tax. This tax applies to commercial property purchased or leased, whether you make your own decision about whether to include it in your property's sales price, or you allow a third party to do so. If you pay sales taxes to another state on your property, you're responsible for paying the tax on this return. The tax code requires you to pay the tax on a sales tax return, whether you pay the sales taxes yourself, or accept from the seller that you'll include the tax as part of the total sales price. Businesses must report the value of goods/services as taxable.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.