Award-winning PDF software

Form 1065 (Schedule C) Lakewood Colorado: What You Should Know

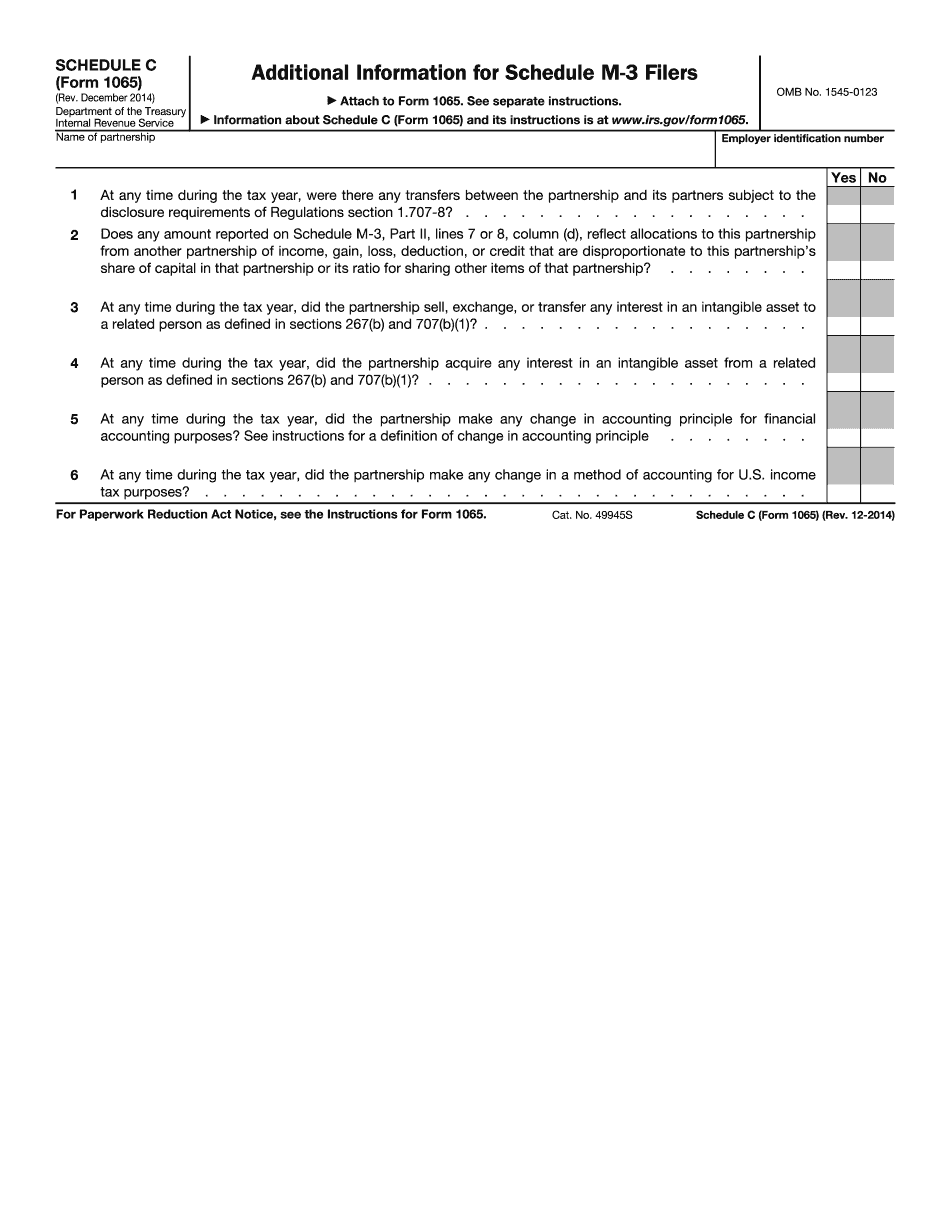

Ordinance No. 3.05.020, dated October 19, 2015, as amended by ordinance No. 3.05.040, dated January 20, 2017, adopted by the City of Lakewood in its second regular session, as amended. The City Council adopts Ordinance No. 3.05.040 to be the new ordinance. B. The City Council, in its sole discretion, may amend or repeal the ordinance at any time by a vote of the voting members present and voting during the regular or special meeting unless the City Council votes to delay the adoption of such change if the purpose of the change is to implement an increase, as determined by any annual budget approved by the City Council. The City Council shall adopt a resolution specifying the purpose of any such change. C. No later than thirty (30) days after the adoption of the final amendment, the City Council shall provide a copy of this ordinance and supporting ordinance and a notice to the public of the final amendment to this ordinance and supporting ordinance to the owners of record of all real property within the city. D. If an objection to the amendment is filed within thirty (30) days after the final amendment is adopted, a hearing on the objection shall be scheduled to be held within thirty (30) days after the filing of the objection. E. The final amendment and any additional ordinance adopted by the City Council to implement it shall be enacted and implemented by the City Council unless the City Council votes in favor of a delay of the adoption of the change if the purpose of the change is to implement an increase, to implement a change that may not have an annual budget approved by the City Council, or to implement an increase that does not result in an annual budget increase greater than 30,000. Tax Forms and Publications Form 1040 (Schedule A), Form, Information for Businesses, Form, Form for Businesses, Instruction, Instruction. 1065 (Schedule L), Instruction, Instruction. Use tax applies to every business located in Lakewood that makes purchases other than inventory. For Lakewood, the use tax rate is 3.0%. City of Lakewood Tax Forms. Use tax applies to every business located in Lakewood that makes purchases other than inventory. For Lakewood, the use tax rate is 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.