Award-winning PDF software

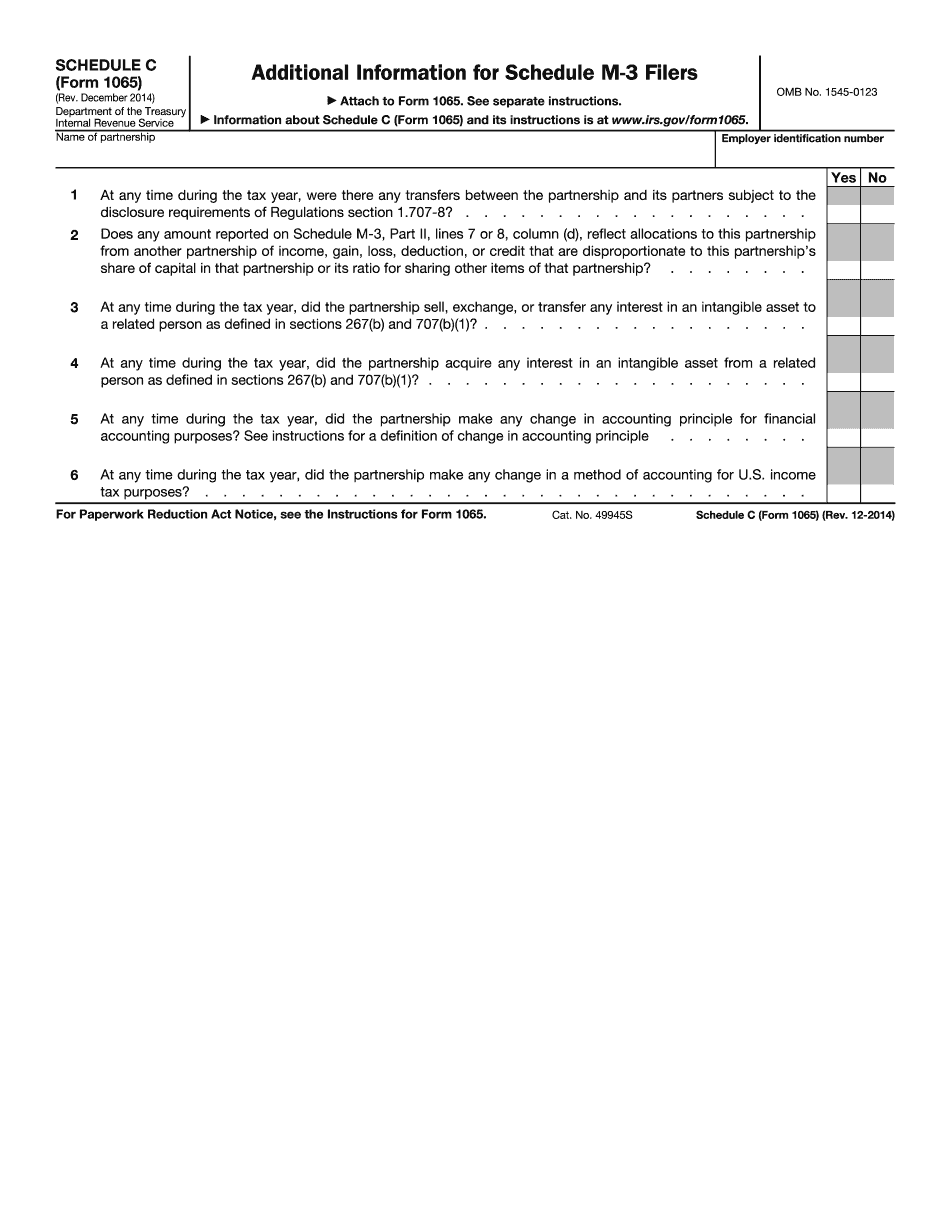

Form 1065 (Schedule C) online Provo Utah: What You Should Know

P.O. Box 1201 | Orem, UT 84 Business or Entity-Related Questions | ▷. Check with the IRS Office of Professional Responsibility for an opinion about your proposed partnership or business. ▷ To make a Form 1065, complete the form and mail it in with any foreign income Information or assistance — Utah State Tax Commission We are here to be of assistance to you through the tax process. Whether you have questions concerning 1065 or other Utah taxes, you have come to the right place. We are here to assist you. If you have a business, you can use this site to find a partner to help you. It is especially helpful for small businesses, sole proprietorship and partnerships who would otherwise be unable to find a partner, because they may not meet a state's minimum requirements. If you are a new or small business in Utah, you can download an Application for Tax Exemption for a Small Business, or you can call our office at. We are a small business tax center and provide free Tax Assistance to Utah taxpayers in need of Tax Assistance. When you can apply for relief from Utah taxation, you could be eligible to: Get a Tax Credit for Your Business Apply for a Tax Credit to Yourself or to a Company or Property for Small Business Apply for an Exemption for Your Business Get a Credit for the Business Interest You Pay If you are a sole proprietor, there are many ways you can apply for relief from your Utah taxable income. If you are a corporation or partnership in Utah, you have many rights for relief from the tax liabilities of your state. For a list of the forms that can help you, click here. If you are in any of these cases, please be patient while we process your paperwork. We have no time to do administrative paperwork such as forms, fill in forms, send the forms, or do any of this. In many cases, it was too much for us to do that work ourselves, so we had to turn to another firm for assistance. We do hope you will give us a call or email so that we can answer your questions. If there is any other question, please feel free to email us at: Taxpayers, please note that this section was created by Taxpayers.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) online Provo Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) online Provo Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) online Provo Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) online Provo Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.