Award-winning PDF software

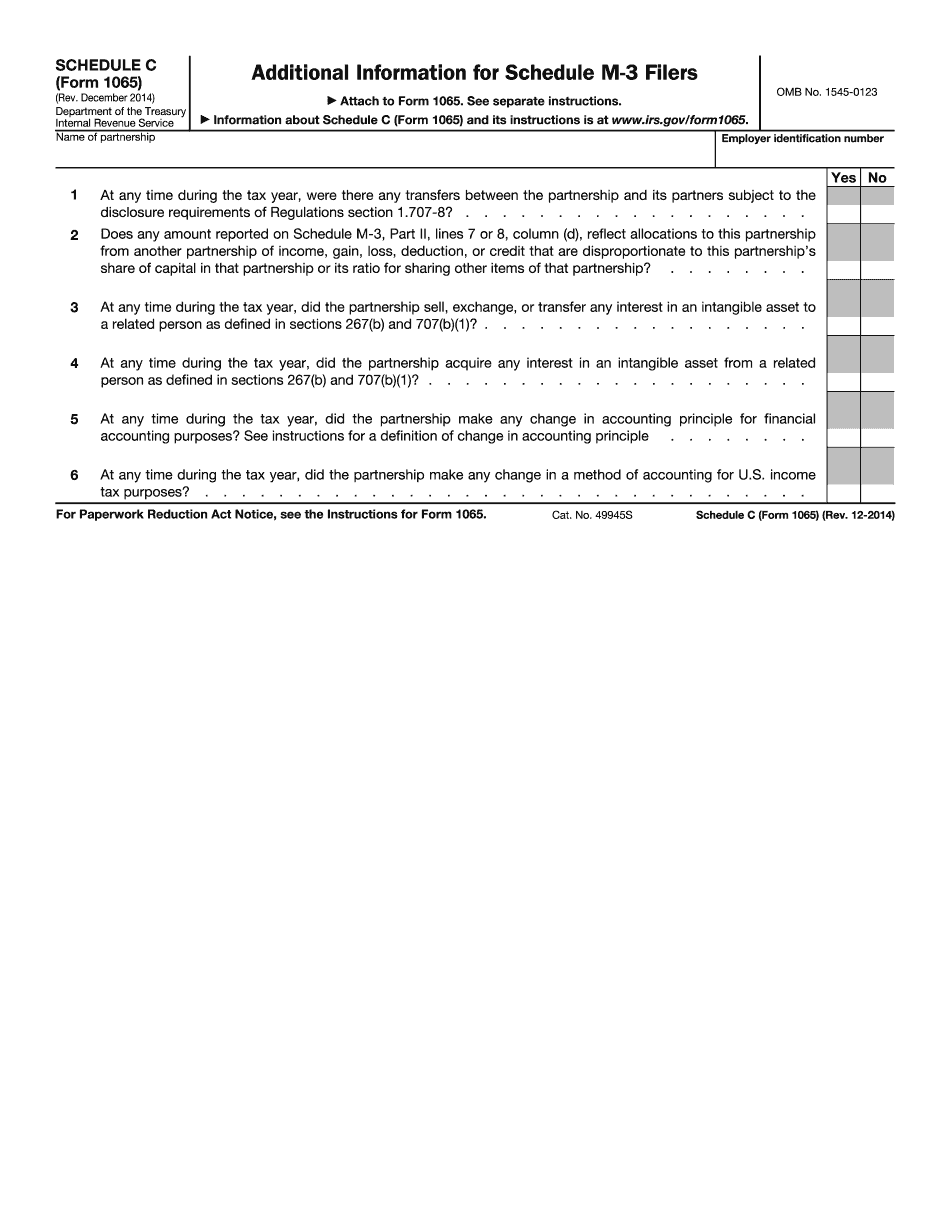

Form 1065 (Schedule C) West Valley City Utah: What You Should Know

Email: taxconsult3-w.com What Else should I know About the Tax Cuts? The Tax Cuts and Jobs Act also repealed the individual mandate, which was part of Obamacare, and also created the Health Savings Accounts. Here are some important provisions: Health Savings Accounts: The legislation allows individuals to set up Health Savings Accounts that give people the option of saving money tax-free for medical expenses. Has will be grandfathered into the Affordable Care Act. However, these funds will not be available for other purposes, such as medical costs, health insurance premiums, and out-of-pocket medical expenses (not including premiums paid with pre-tax dollars), from 2018; the individual mandate, however, will be enforced until 2020. The legislation also allows Americans with low- and moderate-income health insurance to use the amount in their Health Savings Accounts to pay for covered medical expenses without having to pay a penalty (or the tax on high-value health insurance policies). High-Eligibility Health Plans: Heels (employer sponsored, individual-based, catastrophic) are now able to provide high-deductible health insurance. High-deductible health plans were available for people with incomes up to 400% of the federal poverty level, but were not available for people with incomes over 400% of the federal poverty level (and those incomes were significantly higher prior to Obamacare). If individuals or families already had such high-deductible health coverage at the start of 2018, their coverage would not change. But beginning in 2019, these plans will now be available to people with incomes between 400% and 400.25% of the poverty level. ACA-compliant Health Insurance: Individuals will, in 2018, be able to purchase coverage if it offers at least one of the following options (with some limitations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) West Valley City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) West Valley City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) West Valley City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) West Valley City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.