Award-winning PDF software

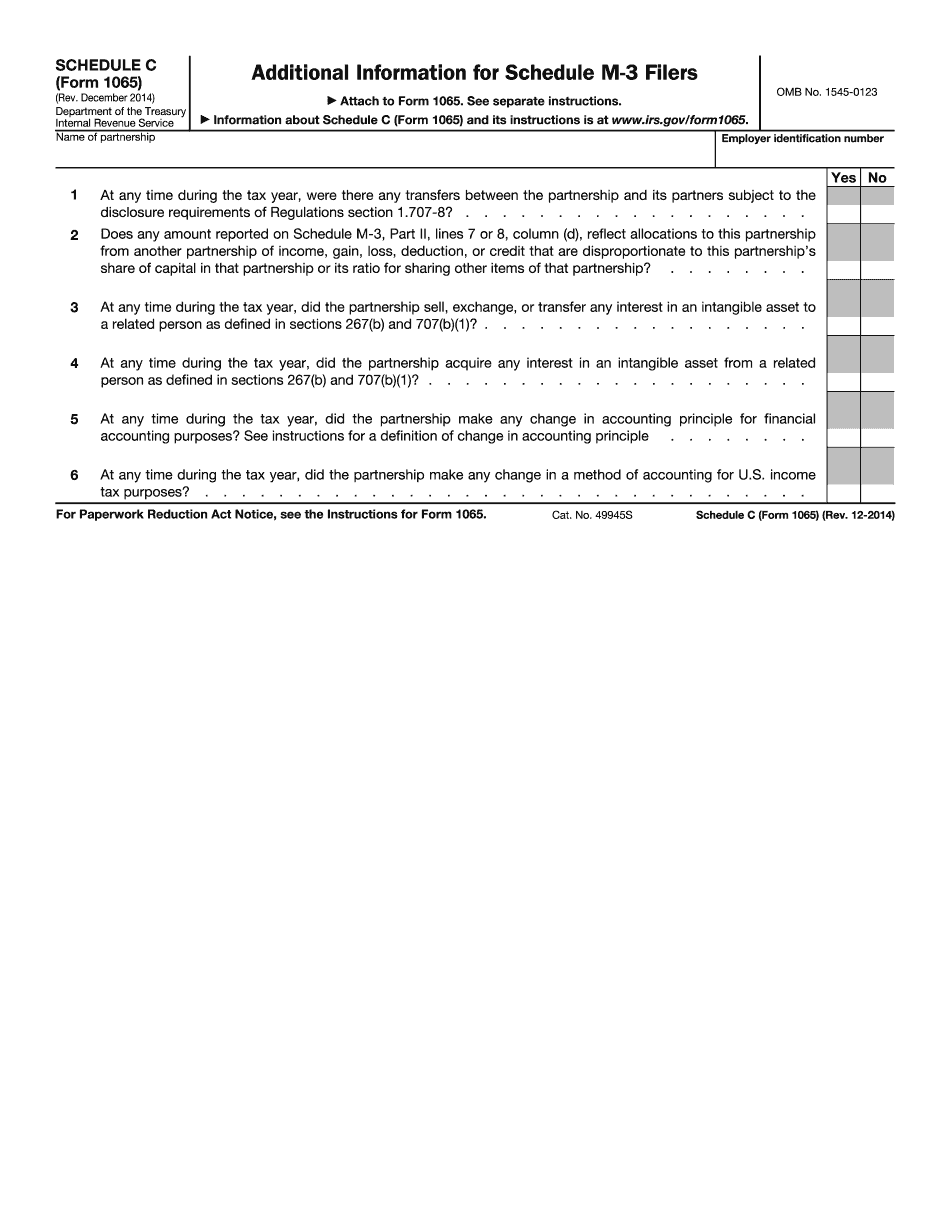

Odessa Texas online Form 1065 (Schedule C): What You Should Know

ECID's BE Certification is accepted for all public entities in the State of Texas. The BE program is a business audit and regulatory compliance program for business enterprises. The program will be administered by the Central Texas Economic Development (CITED) office located at the Dallas headquarters of ECID (formerly ECO Foundation) located in Central Dallas, Texas. BE has three components: (1) The certification will be issued based on your firm's compliance in relation to the requirements outlined in this certification program (see attached document). (2) The certification program will allow for a firm that wishes certification to make significant amendments to their tax return to reflect their compliance with BE program requirements. (3) BE offers a 100,000 grant for a firm wishing to participate in the program. To view a copy of the BE program guidelines, please call the office at or visit Click here to view the BE program Guidelines. If you have questions about ECID's BE Certification and the BE Program, please call or click here. The BE Program is a certification within the ECID Tax Audit & Compliance (TAC) Program. TAC's TAC program will consist of independent, outside certification tests and examinations to obtain CE (Chartered Accountant) or B.A. in Accounting from an accredited university. Your BA. in accounting or equivalent from an accredited university will fulfill both of the criteria for TAC certification. We will evaluate you through four factors based on your overall TAC assessment and, following completion of those four factors, you will receive TAC certification. To view a copy of TAC's Credential and CE Guidelines, please call, or click here. Click here to view the Tax Credential guidelines Credential Tax Certification Guidelines TAOCcertification The Tax Credential Application will take approximately 10-12 weeks to process. It is strongly recommended that you schedule a meeting with both the Tax Administrator and ECID's Board of Directors to discuss any questions that you may have with regard to TAC's TAC program and the TAOCredential.com Tax Certification Program. The application cannot be completed until TAB has received the completed application.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Odessa Texas online Form 1065 (Schedule C), keep away from glitches and furnish it inside a timely method:

How to complete a Odessa Texas online Form 1065 (Schedule C)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Odessa Texas online Form 1065 (Schedule C) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Odessa Texas online Form 1065 (Schedule C) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.