Award-winning PDF software

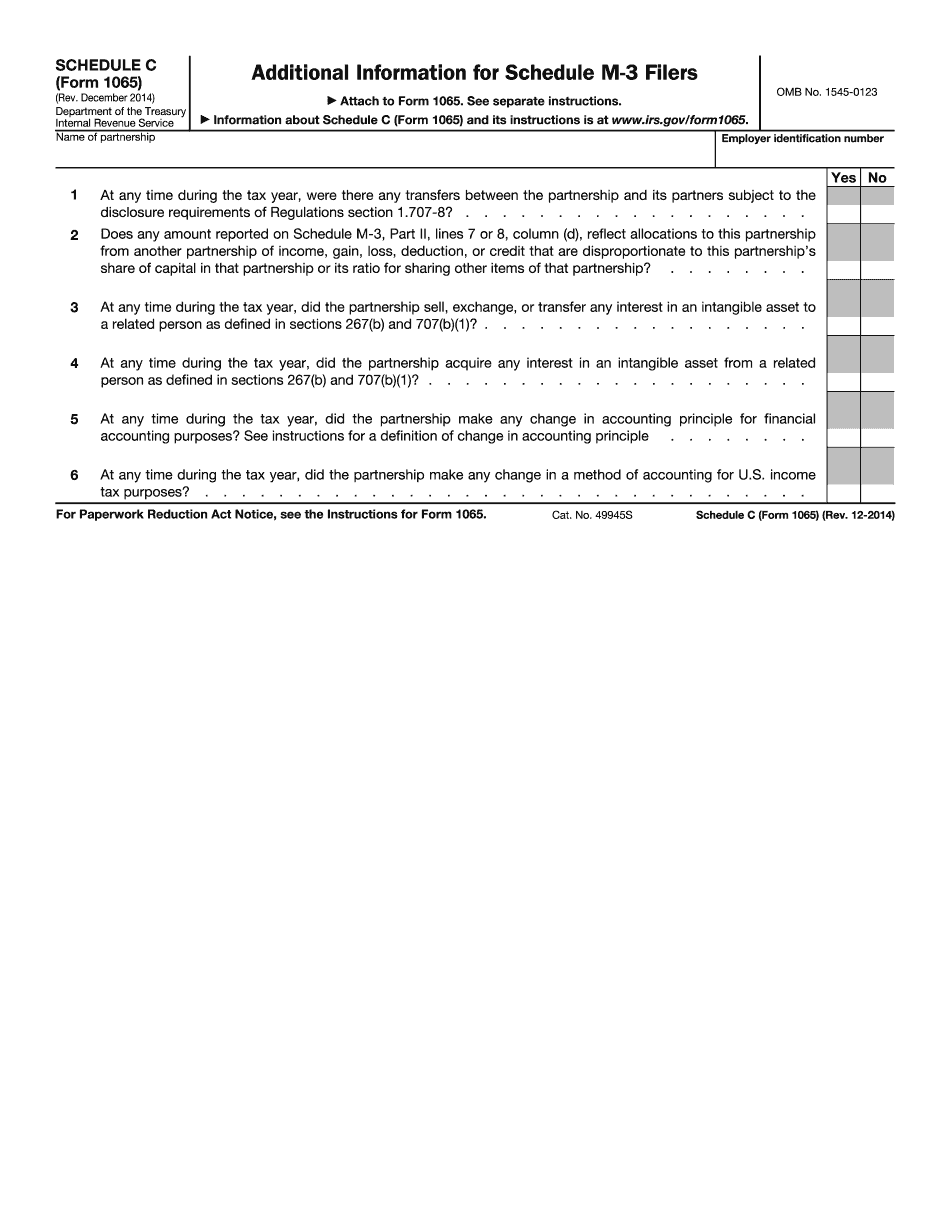

Overland Park Kansas Form 1065 (Schedule C): What You Should Know

Qualified individual” has the meaning of “qualified individual” as defined by K.S.A. 2025 Supp. 82-706, and amendments thereto. (d) Qualified individual‥ means a parent who is physically present in Kansas, and who is either (i) The primary or only parent of a qualified student and is either the principal and legal guardian or the primary and legal manager of the education, training, or youth services of the qualified student or the qualified student's parent and guardians having such primary custody, and of whom there are 2 parents having custody, who meet the criteria in subsection (e) of this section or the criteria in subsection (f) of this section; provided, however, that nothing in this subsection shall be construed as precluding a parent who is not a legal parent, from receiving a portion of the qualified students net tuition from the resident parent or a qualified student while the residency requirement of subsection (b) of section 689-11 or subsection (e) of section 689-11(b) of this title has not been accomplished; or (ii) The students principal and legal guardian and a school district and city, school district, corporation, or foundation having custody of the individual. 6. In computing adjusted taxable gross income for a taxable year, the following factors shall be used: (a) The students home States tax of 15,000. For purposes of this subsection, the tax rate on qualified income is the amount of the tax computed on the excess of the students federal adjusted gross income over the sum of the amount of the students qualified tuition and the qualified expenses of attendance and is calculated by computing the students qualified expenses of attendance multiplied by 15,000. (b) The students county, city, or towns educational agency tax of 12,200. The qualified educational expenses of attendance shall not include the following: (i) An amount in excess of 1,000 per month for any eligible student. (ii) An amount in excess of 3,000 per month for any eligible student whose gross income is more than 50,000 per year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Overland Park Kansas Form 1065 (Schedule C), keep away from glitches and furnish it inside a timely method:

How to complete a Overland Park Kansas Form 1065 (Schedule C)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Overland Park Kansas Form 1065 (Schedule C) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Overland Park Kansas Form 1065 (Schedule C) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.