Award-winning PDF software

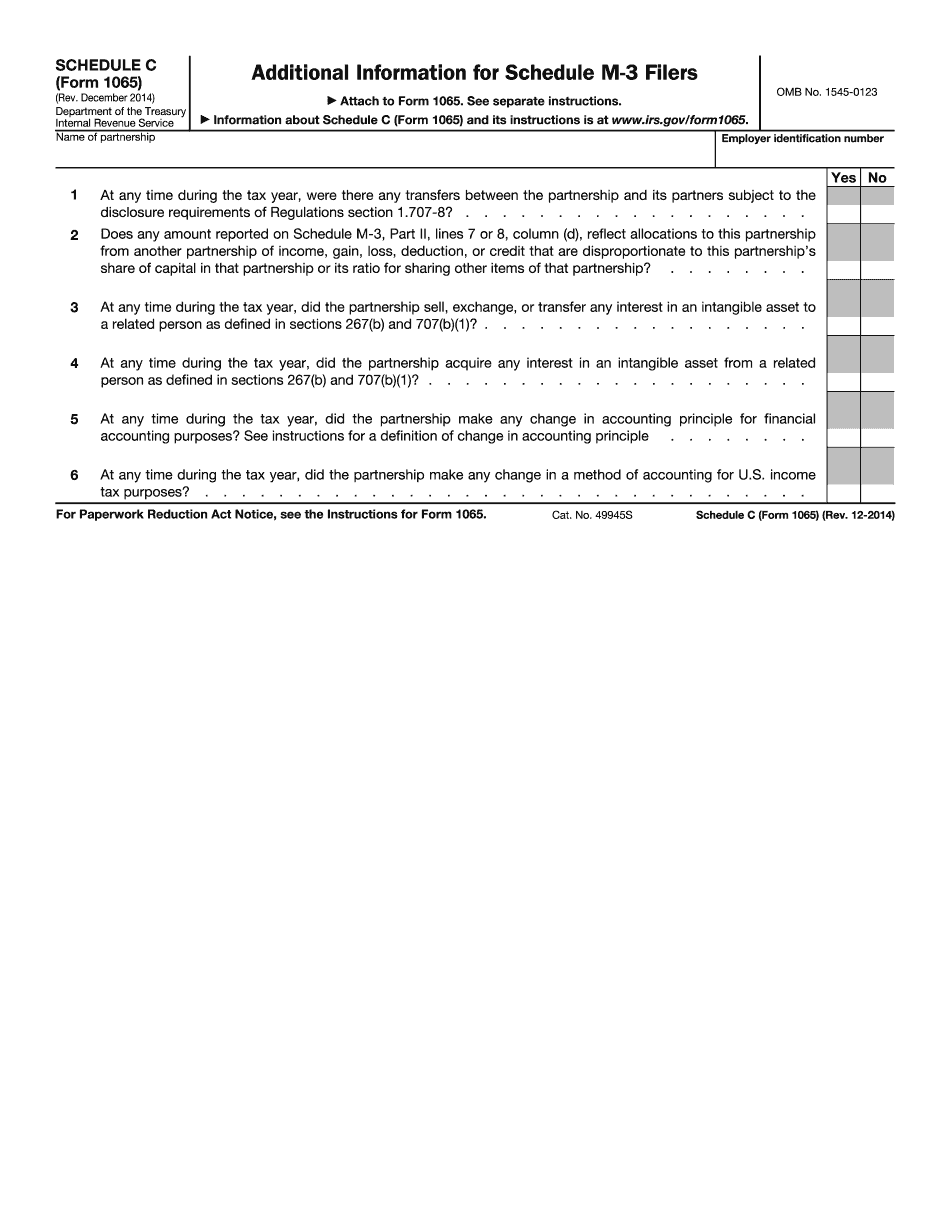

Printable Form 1065 (Schedule C) Olathe Kansas: What You Should Know

IRS Form 1065 Instructions-Payment-by-Mail-Part I Dec 22, 2025 — Beginning April 22, 2021, the IRS will electronically provide a Pay to File option. Pay by mail is the only option for individuals or small businesses with gross annual incomes below 100,000 and 75,000,000, who have paid all their federal tax(s) and have pending state and local tax returns. How to File Form 1065: Step-by-Step Guide Nov 8, 2025 — To file your return, you will first need to complete a return and pay any appropriate federal tax and any federal and state income tax owed. Fill out the form, submit the payment to the proper government agency. IRS Form 1065 Instructions-Payment-by-Mail-Part II Oct 28, 2030 — As you get ready to file, the IRS will provide you with a new option for filing your return by check. Use the new option when you make your first payment. It will ensure that the first payment you make does not result in penalties. How to Pay Your Exemptions. — NerdWallet Sep 29, 2025 — Beginning April 30, 2021, only those taxpayers with Adjusted Gross Income (AGI) under 100,000 and 75,000,000 will have to make income tax payments. IRS Form 1065 Instructions-Payment-by-Mail-Part III Dec 22, 2031 — The IRS will become EIN–enabled. The Form 1065 instructions remain, but the Form 1065 will be paid electronically to the Internal Revenue Service's Taxpayer Processing Division. IRS Form 1065 Instructions-Payment-by-Mail-Part V Sept 30, 2033 — Beginning November 14, 2033, taxpayers will have an option of paying their taxes electronically by Direct Debit (with electronic confirmation from the Internal Revenue Service). Note: This date only applies to taxpayers in which the last payment was made before November 14, 2021. How To File Your Return This tool will walk you through each of the steps you'll need to take to file your return electronically. IRS Forms & Publications Read these IRS publications to learn about filing for an electronic return and the IRS services and programs available to help you: IRS Simplified Filing Software File an electronic return You can file an electronic return if: You own or operate your business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1065 (Schedule C) Olathe Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1065 (Schedule C) Olathe Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1065 (Schedule C) Olathe Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1065 (Schedule C) Olathe Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.