Award-winning PDF software

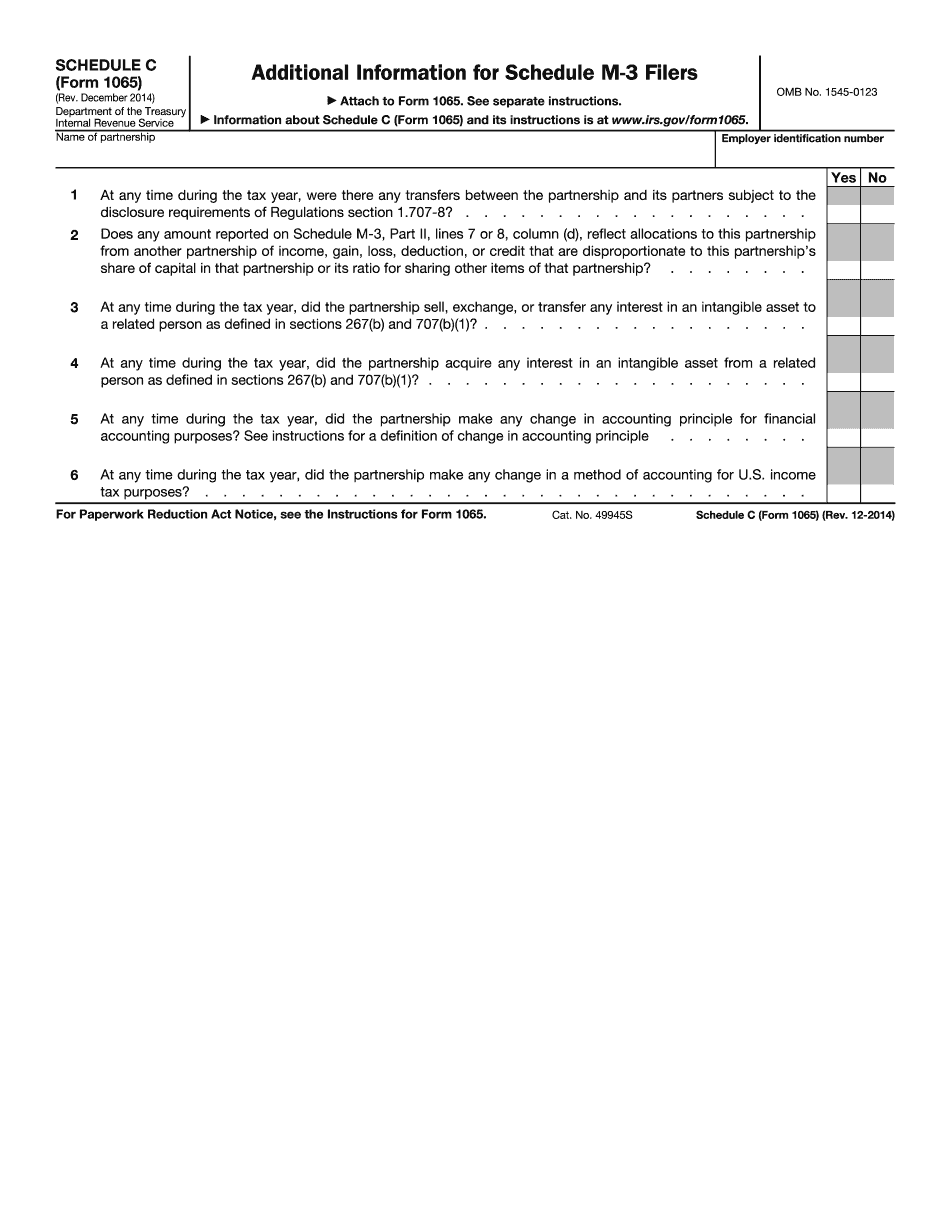

Pima Arizona Form 1065 (Schedule C): What You Should Know

CALIFORNIA 2018 Tax Filing Deadlines January 30th, 2025 for Individual 2025 taxes; February 14th, 2025 for Joint Filers. January 31st, 2025 for Nonresident 2025 taxes. March 31st for Individual 2025 taxes, June 30th for Joint Filing Parents of a minor. 2018 Business Income Taxes (Form 1065, Form 1040, Table I) Table of Contents : A. Arizona Income Tax B. Capital Gains and Distributions from Capital Gains C. Estate Tax D. Individual Income Tax Table E. Business Taxes (Forms 5400-EZ, 5400-LG, 5405X, 5410D, and 5410J) F. Social Security and Medicare (Form 6010) G. Insurance Income In summary, this form is for those who file as self-employed persons and are taxed under a single rate of 7.75 percent on the amount of net income and 7.25 percent on the amount of gain of the business. There is no income tax for the individuals whose gross incomes do not exceed 25,000 annually. The tax for all the entities is the same— 7.25 percent in the first 8,500 in taxable income and 7.75 percent in the last 28,000 of taxable income. A. Arizona Income Tax : The tax on capital gains is 9.50 percent of the amount of taxable capital gain, adjusted for inflation, and subject to special rates of 6 percent, 7 percent, 8 percent, and 9 percent. Capital gain for businesses is subject to the tax imposed by Section 11.0101-5(B), Arizona Business Tax Ordinance. Section 11.0101-5(A) provides a special deduction allowable for those owners of S corporations or partnerships who deduct the business interest rate and expenses in lieu of the general personal exemption. If an owner of a business is a corporation organized for profit under Section 1351 of the Internal Revenue Code or a partnership organized for profit under 18 U.S.C. Section 1256(a), then that business income tax is subject to the 8 percent marginal income tax rate and the individual income tax rate. B. Capital Gains : Capital gains are taxed at a rate of 6 percent of the gain. Capital gains on all other items are taxed at a rate of 8 percent of the gain. C.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Pima Arizona Form 1065 (Schedule C), keep away from glitches and furnish it inside a timely method:

How to complete a Pima Arizona Form 1065 (Schedule C)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Pima Arizona Form 1065 (Schedule C) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Pima Arizona Form 1065 (Schedule C) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.