Award-winning PDF software

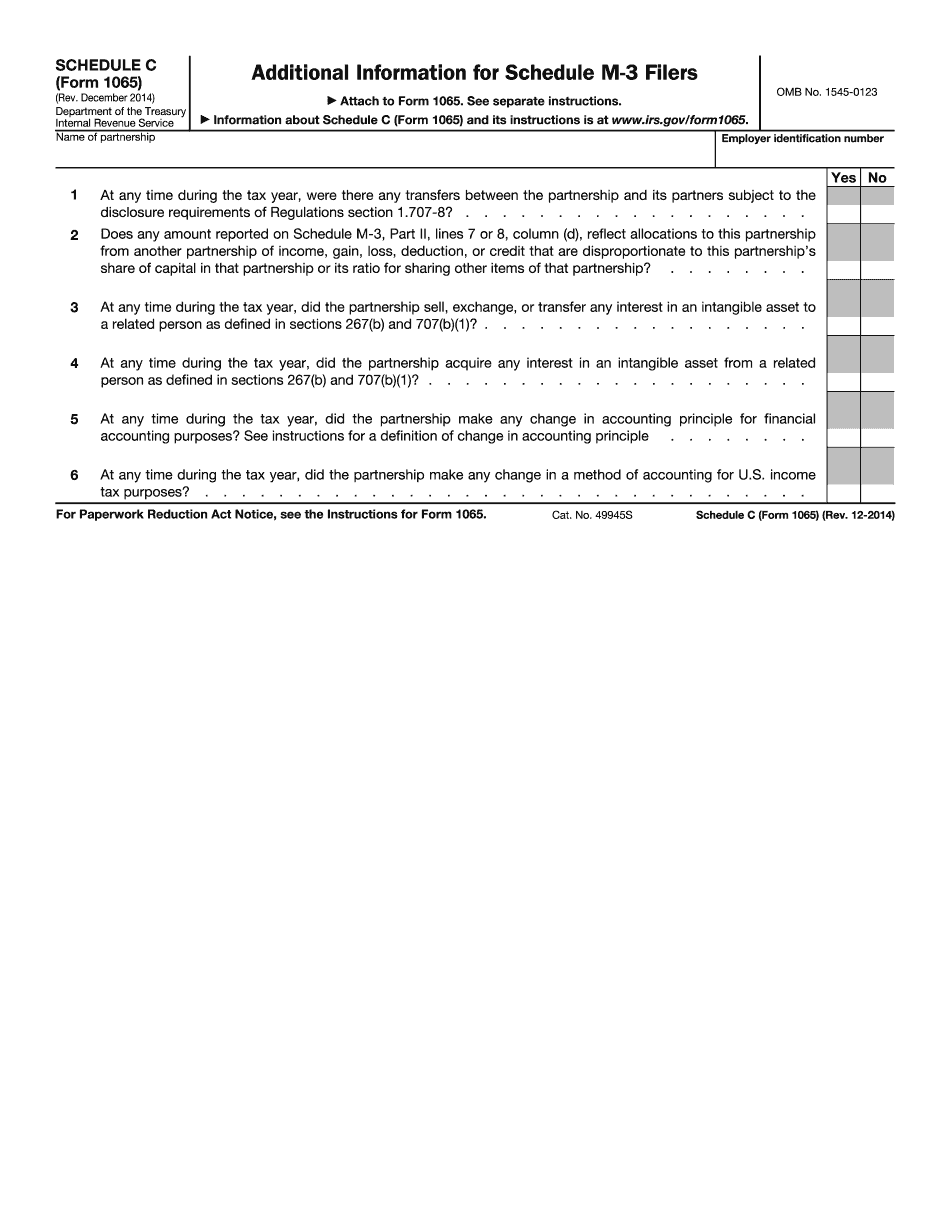

Tarrant Texas online Form 1065 (Schedule C): What You Should Know

Forms · 1-d-1 (Open Space) · Ambulatory health care · Application for Allocation of Value for BPP · Application for September 1 Inventory Appraisal · Appointment of Tarrant County Small Business Assistance Grant — City of Hurst The Small Business Grant Information and Application can be accessed from the main page on Tarrant. County's website under “Trending” at TarrantCounty.com The City and County of Tarrant will conduct an inventory of any properties owned by the City or the County under a contract with a licensed appraiser. The inventory is conducted to ensure that such property is not being used for any prohibited purposes. When the property has not been determined to be used for a prohibited purpose the amount of sales and use tax due on taxable sale of the property is reduced to zero. A property that is determined to have a prohibition is subject to sales and use tax as a general property. A prohibited use for a general property is a nonrefundable tax. Tax Rates Included in the current tax rate structure are exemptions for qualified nursing facilities. For questions please call. Assumed names — TarrantCounty.com Taxes: Revenue and Taxation of Tarrant County and City of Hurst City of Tarrant.gov Property Assessment (2014) Property Assessment (2016) City of Hurst.org Tarrant County does not recognize residential real estate transfers. In the event that an exemption will be sought for a residential real estate transfer, we will forward this exemption application to the local appraisal district. We encourage the use of a Registered Appraiser. There are no application requirements for the County and City. If your assessment will be reviewed by your appraisal district, you should review or obtain from the appraisal district's website its requirements: There is one fee associated with residential real estate transfers in the County — the sales tax for that assessment. We pay this fee directly to the appraisal district. Taxes: Revenue and Taxation of Tarrant County and City of Hurst City of Hurst.gov Property Assessment (2014) Property Assessment (2016) City of Hurst.org County Government City of Hurst.gov Property Assessment (2014) Property Assessment (2016) City of Hurst.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Tarrant Texas online Form 1065 (Schedule C), keep away from glitches and furnish it inside a timely method:

How to complete a Tarrant Texas online Form 1065 (Schedule C)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Tarrant Texas online Form 1065 (Schedule C) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Tarrant Texas online Form 1065 (Schedule C) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.