Award-winning PDF software

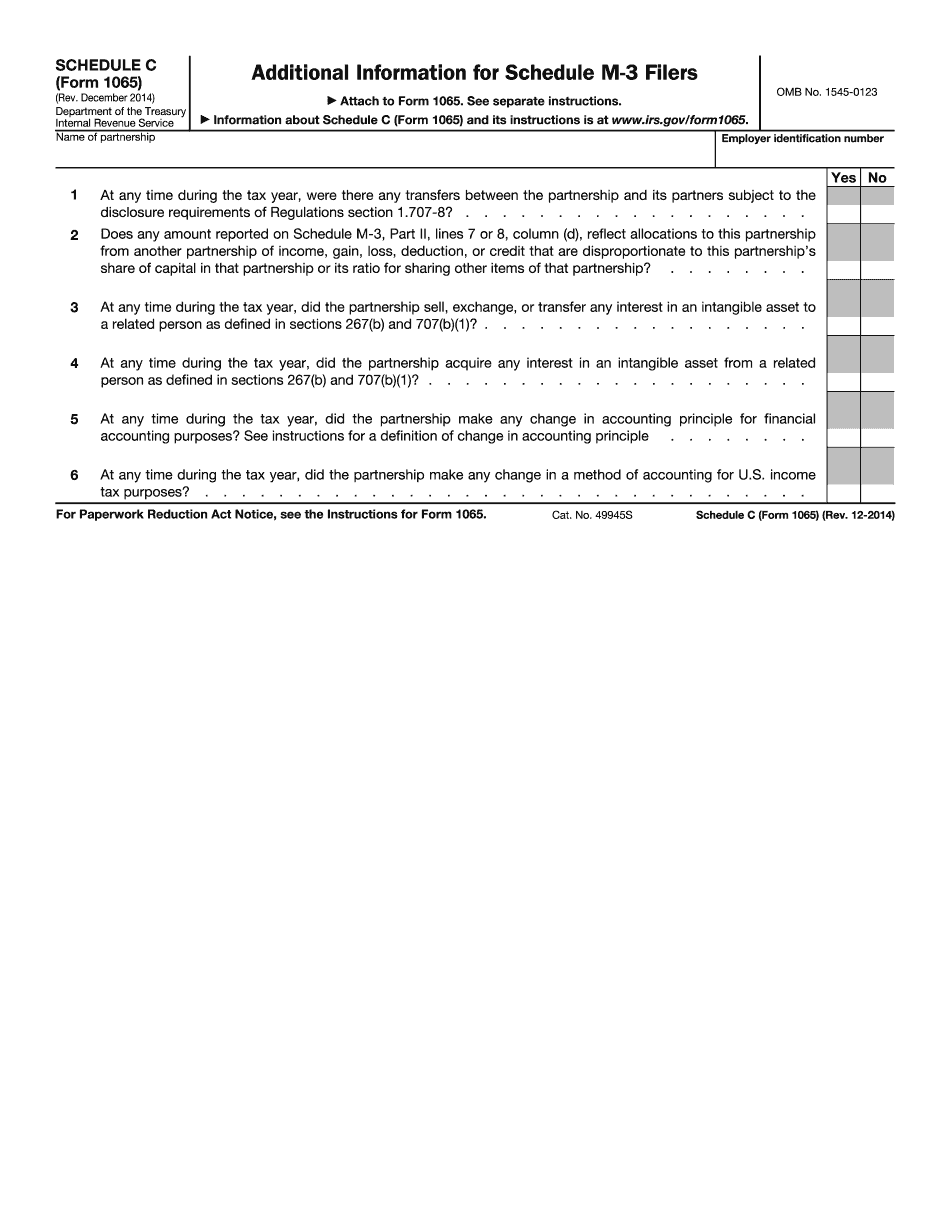

Form 1065 (Schedule C) for Georgia: What You Should Know

Forms and schedules for Schedule D (Form 8582) — State of Georgia Excerpt from the state tax laws: “The following schedules are published by the Office of the Secretary of State and are deemed to be part of Georgia tax law. The schedules and schedules for Schedule D are reprinted for your convenience and are effective as of July 1, 2018.” Forms and Schedules for Schedule D (Form 8582) — State of Georgia The Georgia Department of Revenue website is here. If you need a tax preparer, check out our links below: Get your Georgia tax form, you won't regret it, it's a one-stop-shop for everything including Georgia income tax filing and tax preparation, and more with the Georgia Tax Services website. If you or anyone you know needs a Tax Specialist to work on your tax return, you are eligible for FREE Tax Consultation from a Certified Georgia Financial Tax Counselor and are never billed or required to pay. I just want to offer the Georgia Tax Division one last tip. For a tax professional, make sure that you read and follow every single tip that you are given, be informed regarding your tax obligations from the moment that you receive your Georgia income tax form, and always follow the law. Georgia Income Tax Payment Options Taxpayers can elect to file their tax return online for free via their Georgia Income Tax account, or they can pay electronically to the Georgia Department of Revenue at this website. You will need to provide a valid EFT Number, the amount of your state tax return, and the tax period that you wish to receive your payment. Georgia resident must pay by check to the following address: Georgia Department of Revenue Payment Options Payment Type: Electronic Funds Transfer (EFT) State Tax Exemptions — Georgia Income Tax Return Georgia State Tax Exemptions for Income Tax Year (Effective October 1, 2015) All taxpayers in Georgia are entitled to some or all of the following tax exemptions from the Georgia income tax. The exemptions will only be paid directly to the state of Georgia. They will NOT be deducted from your Georgia income tax return. If you are listed below as receiving any of these state tax exemptions, you will NOT be able to claim the exemption as income tax refund. Elderly exemption (EIA) — The Federal government provides tax rebates to elderly residents.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.