Award-winning PDF software

Form 1065 (Schedule C) for Eugene Oregon: What You Should Know

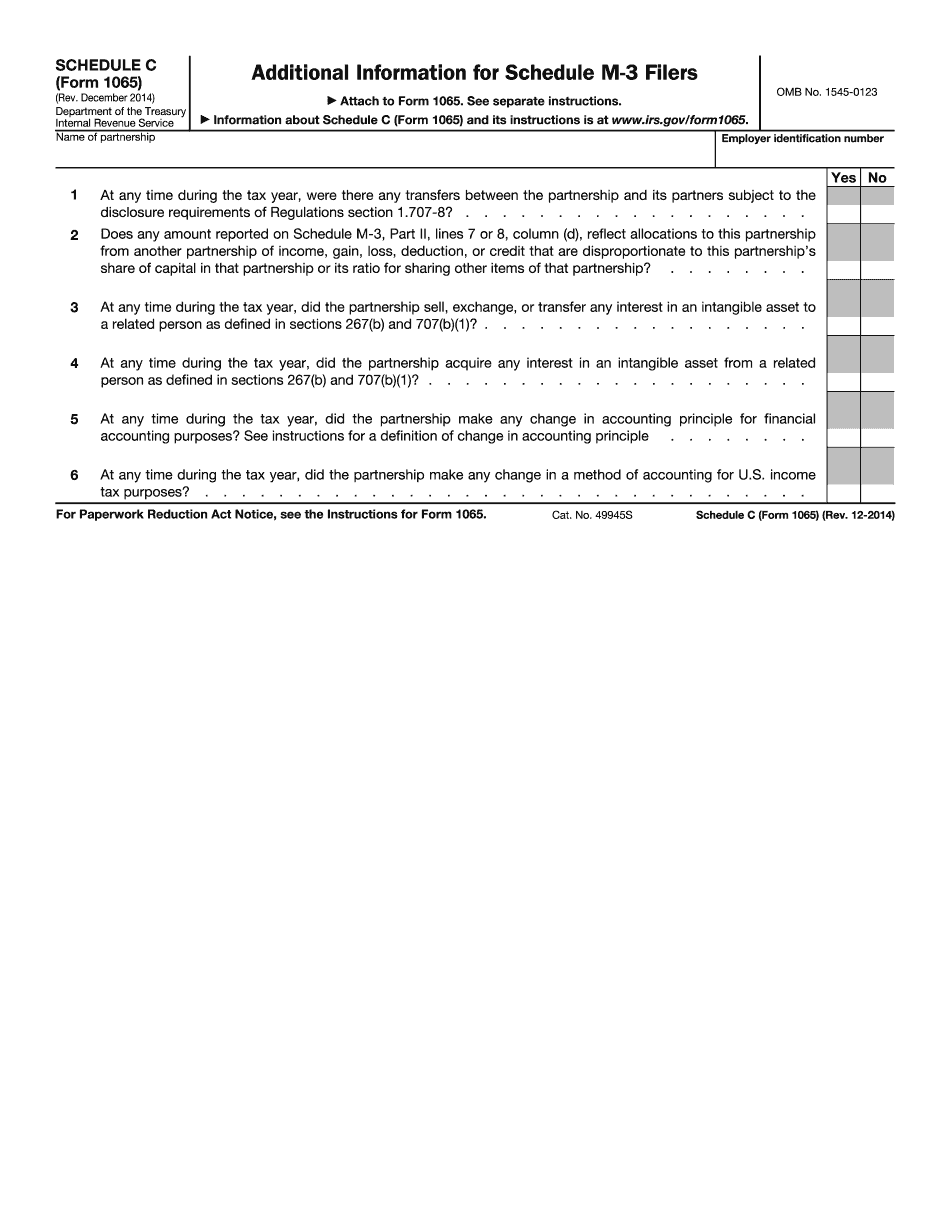

S. Tax Law for Filing Partnership Returns with the I.R.S. This notice is also part of a notice about changes to the U.S. tax laws that came into effect on October 26, 2017. There are lots of good and bad things about this notice. I'll explain the good stuff first. The good stuff The “I.R.S. will be able to provide online services” (that is, they will be able to do online tax filing), but the process will take longer, and it will be more complicated. There's no penalty for filing with a return preparation service to reduce the time you have to spend filling out forms. For those without a tax return preparation service, it would still be reasonable to pay someone to file a schedule C (Form 1065) using the Form 1065. This will cost roughly 30 more per return, but it's a worthwhile expense for an entity that is likely operating in the gray area of IRS taxation. The process for filing Schedule C (Form 1065) using Form 1065 forms is more complicated and time-consuming than filing a business tax return using Schedule C-EZ (Form 2055) but it's still not time-consuming. You can get a copy of the tax forms for all the U.S. tax years for which the Schedule C (Form 1065) is applicable at . I'm a bit skeptical of having taxpayers pay this cost to reduce the work required to file Schedule C. The process isn't a tax return preparation service. There's no way for you to get a list of all your tax expenses, so there's no way for anyone to know the real cost to prepare your Schedule C (Form 1065). As a result, it's impossible to tell whether the IRS thinks it will be beneficial for taxpayers to keep any of this information and pay the cost to reduce the work to file. It's unlikely you will be able to get the same sort of tax return preparation services (or similar) that you can now, so it may be difficult to make money from this service. The tax forms are for all the income years. A lot of taxpayers who are now filing Schedule C with Form 1065 won't be able to file it with Form 1040 (or other versions of 1040).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 (Schedule C) for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 (Schedule C) for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 (Schedule C) for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 (Schedule C) for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.