Award-winning PDF software

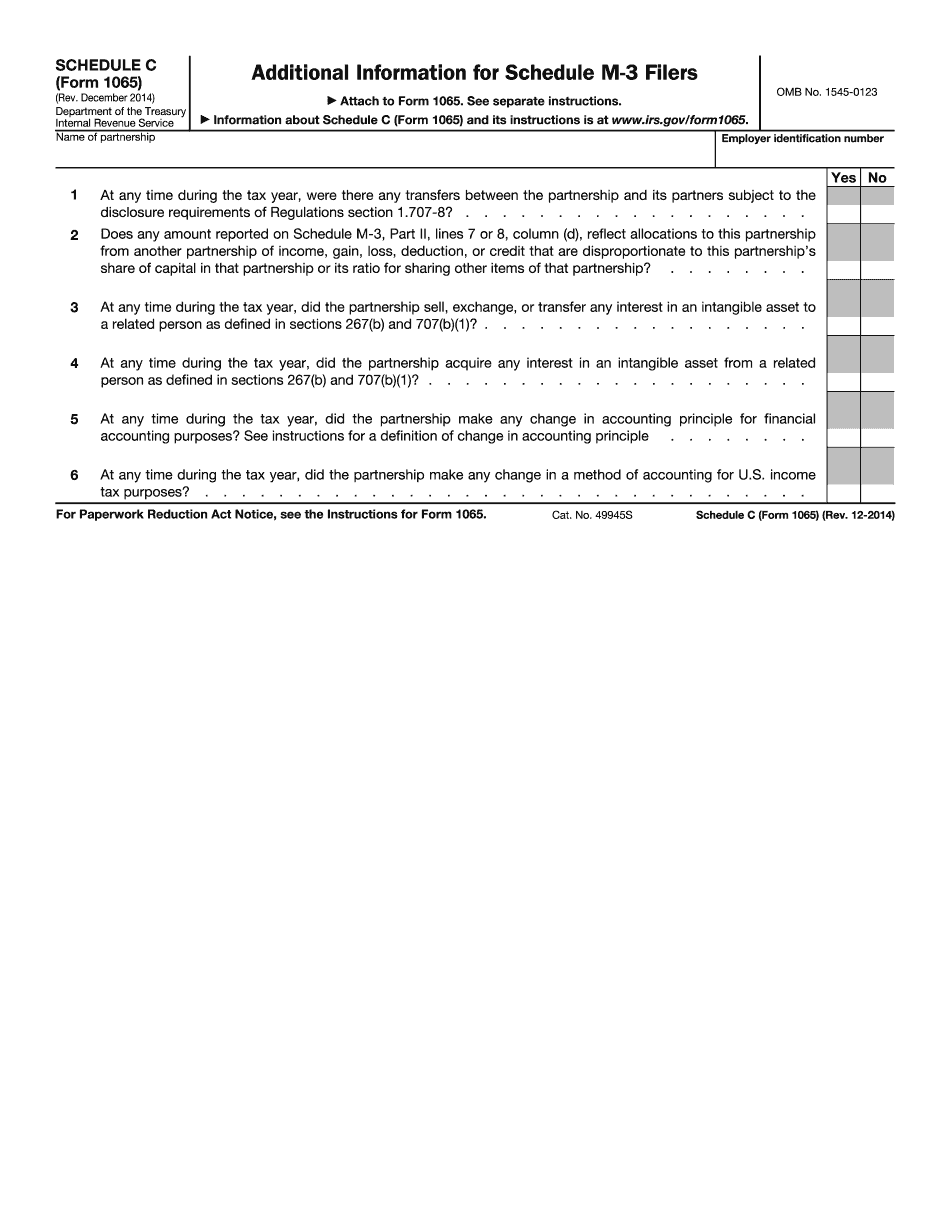

OK online Form 1065 (Schedule C): What You Should Know

Partner's Return, on the due date Feb 2, 2025 — Forms 1065 for partnership income tax liability. Schedule K-1 must be completed and filed Nov 6, 2050 — The Internal Revenue Code was revised to increase the taxable income of qualified business income. 1065 – 2050 Nov 6, 2048 — Form 505 — Nonqualified Business Income, Form 512 — Dividends, and Schedule SE — Self-Employed (You can complete all these schedules with the same form) Dec 29, 2050 -- Schedule SE — Self-Employed. Dec 28, 2051 -- Schedule K-1. Report the income you receive from your S corporation or qualified pass-through corporation and its individual shareholders on your Schedule K-1 if they meet the capitalization requirements (see Income Tax Rates for Schedule K-1). 2051 Schedules K-2 & K-3 — Schedule SE — Self-Employed. This is very similar to the schedule you can complete (without filing Form 502) for the walk-throughs. Dec 29, 2051 -- Form 504-C Dec 29, 2025 -- Form 502 — Self-Employed. Form 502 requires that your S corporation or qualified pass-through (see the S corporation vs individual shareholder section for more information) make payments to owners of stock over the value of 1,000 in all qualifying trades. 2035 — Notice 2017–2, Notice 2017–1 Dec 28, 2035 — Notice 2017-1 2035 Notice 2025 — Notice 2018-1 Note: Your 2025 Form 5500-T and Form 5500 will have new instructions. NOTE: The U.S. Department of Treasury has changed many tax regulations. The IRS is working to make these changes as soon as possible. You can help by using this IRS resource that contains changes to the tax regulations that we are working to implement: We have also posted a series of FAQs on the Notice that will help you get your return prepared efficiently. Check often back for the latest versions of these documents. You can also use the IRS Self-Employed Self-Employment Tool to help prepare your return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete OK online Form 1065 (Schedule C), keep away from glitches and furnish it inside a timely method:

How to complete a OK online Form 1065 (Schedule C)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your OK online Form 1065 (Schedule C) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your OK online Form 1065 (Schedule C) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.